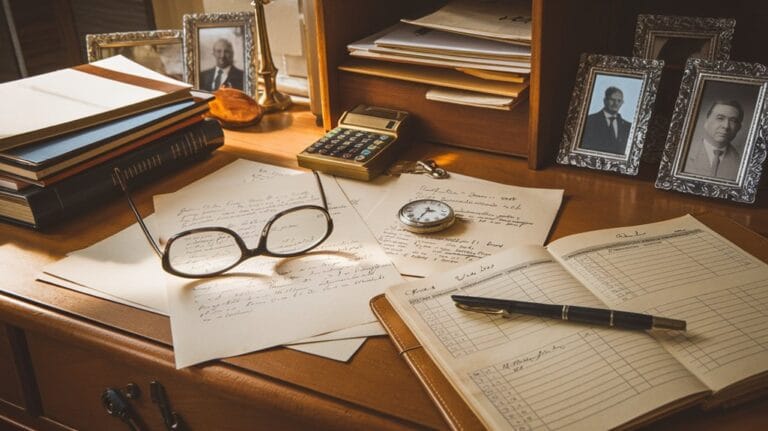

Essential Guide to Asset Protection and Medicaid Planning

Know how to protect your assets before applying for Medicaid benefits, or risk losing everything you've worked hard to save.

Know how to protect your assets before applying for Medicaid benefits, or risk losing everything you've worked hard to save.

Find out how specialized IRA trusts can protect your spouse and children's inheritance while avoiding costly estate planning mistakes.

Optimize your Medicaid eligibility and protect family assets through strategic trusts, but timing these decisions could make or break your future.

Optimize your wealth's security through proven asset protection methods, but the key strategy most planners overlook could change everything.

Inheritance tax planning reveals powerful strategies to protect wealth, but missing these critical steps could cost your heirs dearly.

Careful Medicaid planning can shield your family's assets from devastating nursing home costs, but timing is everything.